Income Tax Standard Deduction For Ay 2025-26. Increased to ₹75,000 for salaried employees. Standard deduction to salaried individuals and pensioners is proposed to be increased from ` 50,000 to ` 75,000 under the new tax regime.

75,000 for taxpayers opting for the new tax regime (section 115bac). In this article we have discussed income tax deduction available to taxpayers from various sources of income for a.y.

Standard Deduction For 2025 Tax Year Rica Venita, Standard deduction to salaried individuals and pensioners is proposed to be increased from ` 50,000 to ` 75,000 under the new tax regime.

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)

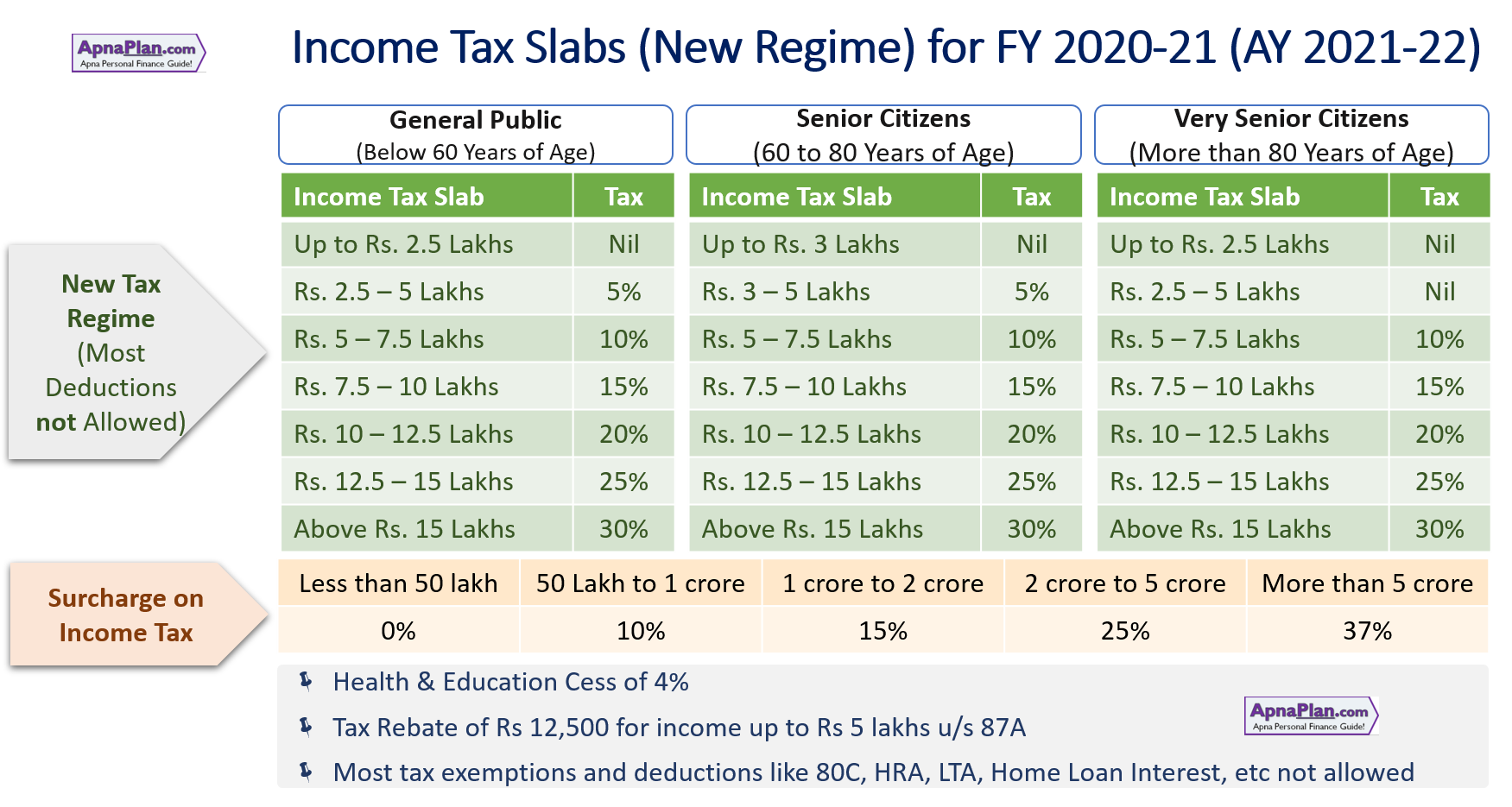

Tax Slab For Ay 202526 New Tax Regime Matty Courtenay, The budget 2025 introduced significant changes to the tax slabs under the new tax regime, which will be.

Tax Calculator Ay 202526 New Regime Eryn Odilia, 75,000 for taxpayers opting for the new tax regime (section 115bac).

Standard Deduction 2025 Taxes And Ora Lavena, 75,000 for taxpayers opting for the new tax regime (section 115bac).

2025 Tax Brackets And Standard Deduction Robby Christie, Finance minister nirmala sitharaman’s budget 2025 modified income tax slabs, favouring the new tax regime.

2025 Tax Brackets And Standard Deduction Calculator Anny Malina, This standard deduction is available.

Taxes 2025 Estimator Salary Kacy Elisabeth, Standard deduction to salaried individuals and pensioners is proposed to be increased from ` 50,000 to ` 75,000 under the new tax regime.

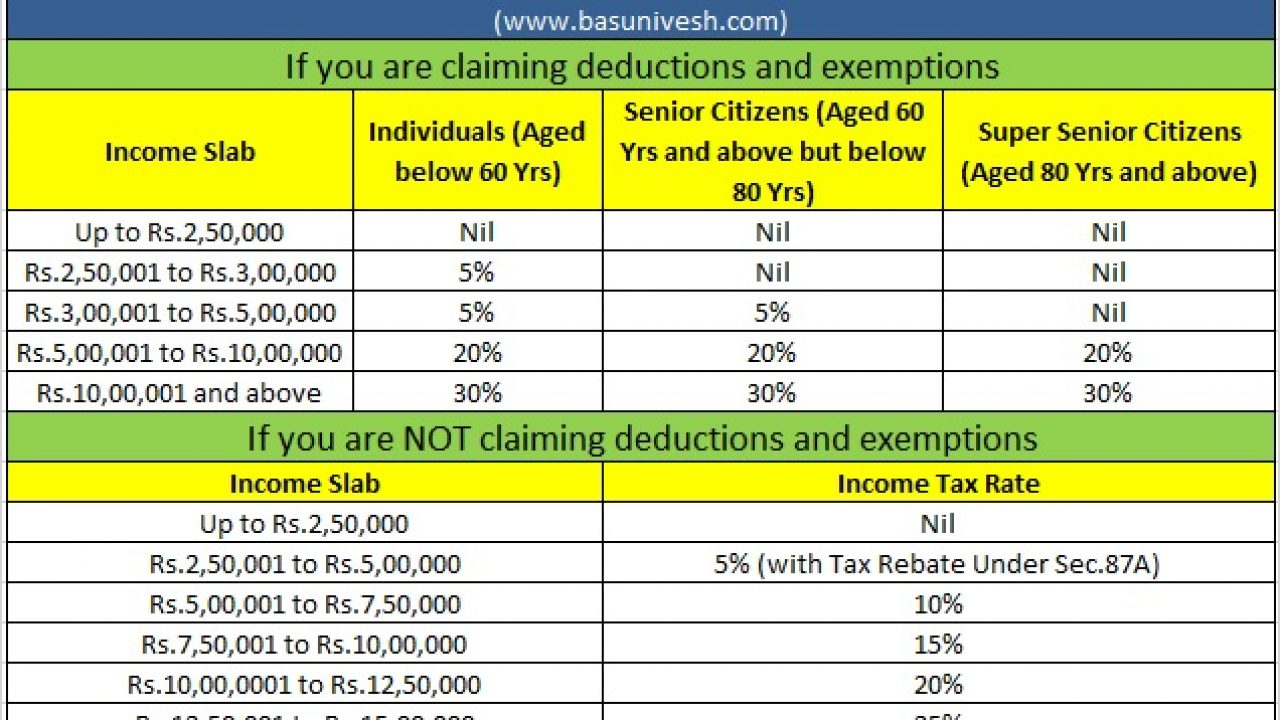

Tax Slab 202425 Tax Slab for AY 202526 I Rebate u/s 87A I Standard Deduction YouTube, Increased to ₹75,000 for salaried employees.

2025 Tax Brackets And Standard Deduction Calculator Anny Malina, In the old tax regime, taxpayers have the option to claim various tax deductions and exemptions.